In this post I will discuss options trading in the most simple way I can do. I will also try to explain how we trade options that work for us.

Let’s start.

There are four ways to trade options: buy call, buy puts, sell call and sell puts.

Here what I will explain is the buy side ( buy calls and buy puts ).

In call options, you want the stock of your choice to trade to the upside in order to make money while put options are to the downside.

Meaning, you are betting here that the stock will go up or go down at a specific time.

How do I know which options contract to take?

Before that, first let’s deal with what the Greeks are for.

Also I will be going over what I do in choosing the correct contracts whether it’s a scalp, longer day trade or swing trade.

I‘ll try my best to keep this simple.

It is important to know the Greeks (Delta, Gamma, Theta and Vega) as these are the factors that go with the option contracts.

Delta

The amount your contract increases in value for a $1 move of the stock.

The further IN THE MONEY you are, the higher delta will be.

Example:

Let say X Corp. stock is currently bought and sold on an exchange and there are calls and puts options traded for these securities.

The deltas for call is 0.35 (this means that a $1 change in the price of X Corp. will give you $0.35 change in the price of call options), so if X Corp. trades at $100 and the call option premium trades at $1.00, a change in the price of X Corp. to $101 means the call option will become $1.35

Gamma

The rate of change for delta for a $1 move in the stock.

Ok so as the stock moves, the delta value moves. How much will the delta move based on a $1 stock movement — gamma tells you this.

It is actually the rate of change of option’s delta.

Let’s say X Corp. stock has a gamma of 0.10 and a delta of 0.35; and the underlying moves up $1.00; the option will then have a delta of 0.45.

Note that the gamma is highest at ATM (At the Money) and decreases as you further Out or In the Money.

Theta

Also known as the time decay.

This shows how much value will the contract lose for 1 day of time.

I called this killer theta.

If you trade 0DTE (zero date to expiry) and the stock goes sideways, that how your premium got burned and killed.

For ATM (At the Money) contracts, it increases as your contract approaches expiration, meaning as time goes on, you lose more money.

Options with strike prices that are near the money are most sensitive to IV (implied volatility) changes.

On the other hand, options that are further in the money or out of the money will be less sensitive to IV (implied volatility) changes.

For ATM (At the Money) or OTM (Out the Money) contracts, as time goes on, theta decreases.

Means as time goes on, you will lose money, but loss less and less each time

The further away option contract expiration you pick, the less time decay there will be.

Further away expiration = safer

Vega

Measures how the price of an option changes based on the stocks volatility.

Higher Vega for me means an expensive contract.

The more volatile the stock, the more expensive the option contract is.

You’ll notice this during the time of the earnings report or with an important news catalyst.

If we trade options, we try not to overthink the greeks. The reason why you need to understand the Greeks, is it will give you an edge of knowing the odds of making a money out of the price action of the stock.

In our opinion, the volume of the contracts in a particular stock is the most important indicator. If the bid and ask spread in every premium contract is too wide. Do not trade that.

I only trade contracts with up to .15 bid and ask spread. I don’t want to go any further. More than this, I stay the fuck out.

The reason why I can’t go more than a .15 cents spread is for every 10 contracts I buy, it gives me a -$150 floating loss already just by getting into the position. I begin to feel uncomfortable if I have a -$300 floating loss and that’s how emotion starts.

To explain this:

Let’s say I want to trade X Corp to the upside. X Corp is currently trading at $100 and I believe that this will go to $102.

Assuming the same week expiry at $103 asking call strike is at $1.50 while bid is at $1.35.

This means that there is a 0.15 bid-ask spread.

What does this do to your trade?

If I buy 10 contracts at ask, the cost of my trade will be $1500 ($1.50 x 100 x 10 contracts)

By the time I bought this, my trading platform will shows automatically a floating loss of -$150

And this is because of the bid and ask spread.

Why? The bid is only at 1.35 meaning if I want to dump the position right away, I can only sell this back to the market at $1350 ($1.35 x 100 x 10 contracts)

Bid $1350

Ask $1500

Floating loss -$150

So how do we trade options?

There are three ways we trade options.

1. SCALPING

2. DAY TRADE

3. SWING TRADE (holding the contracts overnight).

For every type of trade I listed above, I will be explaining which STRIKE PRICE and EXPIRATION you should take whenever buying contracts.

Let’s start at scalp trade.

Scalping contracts : Strike price

When I scalp, I want to take an (ATM) At the Money or an (ITM) In the Money contracts based on what we know about the greeks,

Why?

The delta value is higher, so every $1 increase in the stock, you make more money than you would at the money contract.

Since you are quick in and out for a scalp you want the most bang for your buck.

This would be taking ATM or ITM contracts.

They’re more expensive, but if you’re scalping a 0.30 cents move, you’ll make more money with ATM or ITM as opposed to OTM

Scalping contracts: Expiration

Weekly contracts are much more volatile than monthly contracts.

Weekly expires that Friday and monthly expires the 3rd Friday of the month.

Since I want to take advantage of the sudden change in premium contracts when I’m scalping, I’ll take a weekly contract as it moves more and scalping is the only way.

Note: it is risky holding a weekly contract overnight especially Thursday and Friday.

Here’s an example of this type of trade.

SCALPING TRADE USING ATM STRIKE AND WEEKLY EXPIRATION

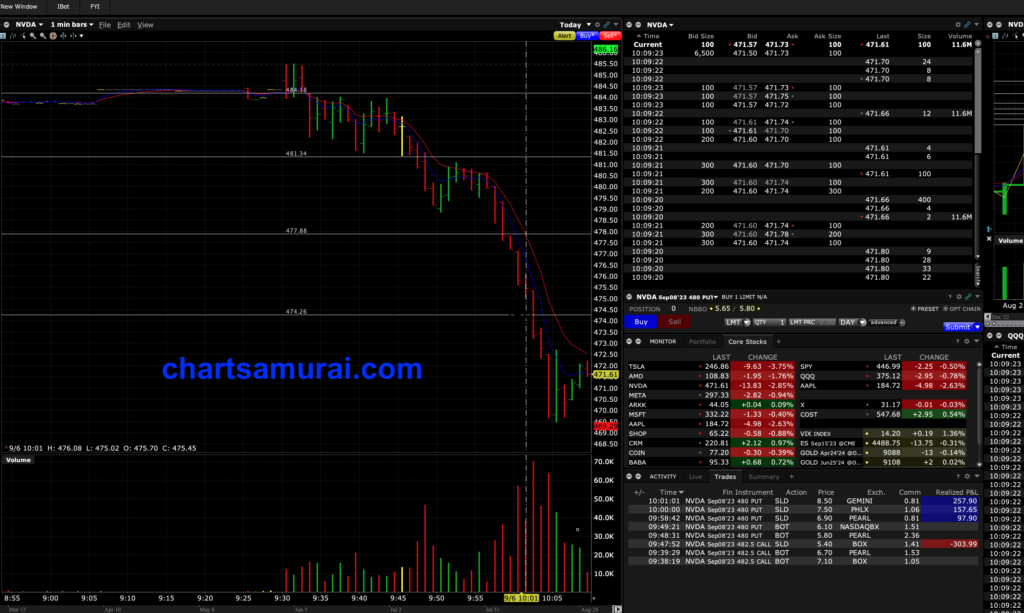

NASDAQ: NVDA (Nvidia)

What I am going to explain here is about scalping the option contract by taking an ATM (At the Money) strike price of Nvidia.

You would notice that I primarily took a loss of -$303.99 during the first round of my trade. I am not going to explain the reasons why I chose the trade, how I arrived at those important levels.

What I am going to show here is this: If I am planning to scalp the contract and the price action is healthy, I am taking an ATM strike contract price.

AT 9:38 AM (EST) NVDA was trading at 482.20, when I took a $482.50 weekly calls, upon failing the support it resulted to a loss of -$303.99

However, at 9:48 am, when I saw some big sellers at $480 I took $480 weekly puts and that time NVDA was at 480.50s.

The plan was to trade all the way to $474.26 and wait for a heavy flush out at the support, but my final limit sell at 8.50 got easily filled during the sell-off.

It was a good trade as it resulted to + $513.45

Overall trade has a net result of + $202.46

Another way is to day trade the contracts.

Day trade: Strike price

What I mean by this is you plan to ride the trend for a little while, whether all day or an hour, a trade longer than a scalp.

Usually I’ll take the ATM contract or I’ll take the strike price closest to my intraday level. If a stock is at $400 and the next intraday level up is $402 then I will usually take a strike price of $402 or $403. I also look at how the stock is moving. If it moves so fucking slowly, I will not trade the options on this.

A larger, more volatile move, yields higher percentage gains with OTM contracts than ATM or ITM, so if it is a fast moving stocks, I will go more OTM (Out the Money).

Example: Let’s say the stock is at $51.25 and then it breaks out in a day to $55.75.

If you buy 1 ATM contract, let’s say the $51 call, for $200, then it will probably worth about $500 when the stock hits $55.

But, if you buy 1 OTM contract, the $55 call, for $40, then it will probably worth about $200

When stock price hits $55.75,

a: $51 call: goes for $200 to $500 = 150% gain

$55 call: goes for $40 to $200 = 400% gain

OTM is cheaper and you can buy more contracts than ATM and possibly get higher percentage gains as seen above, however it is more risky to go OTM.

High risk, high reward.

Day Trade : Expiration

Usually I will go weekly for this since i want to catch a nice volatile move in one day. Put in mind that pullbacks will hurt you a lot on weeklies. If you really want to mitigate risk, take monthly contract If you plan to hold overnight your contracts better take the monthly too.

Lastly, the swing trade (holding the contracts overnight)

Swing Trade : Strike Price

My personal strike choosing technique is pretty simple. Since OTM pays a higher % but is more risky, I’ll find a between ATM and OTM.

First I will set my price target based on weekly and daily chart.

Then I’ll take the strike in the middle of the current price and the target price.

Example : If a stock is currently $180 and my price target is $200, then I will take the $190 strike. If ever I think the swing is perhaps a bit riskier (then mostly I wouldn’t even take it) But then I will take closer to the money.

Swing Trade : Expiration

I do not swing weekly contracts, it’s too risky and too emotionally because of the volatility. If I think the swing will take 3+ weeks or a month then I will likely take 2 months out expiration.

Once I see the expected move in under three weeks, I will start scaling out my swing position and leave 1 contract to see how far can it goes.

HERE’S THE SUMMARY:

IF SCALP TRADE,

Strike : ATM or ITM

Expiration: Weekly You have to be on the right side of the trade.

IF DAY TRADE,

Strike : ATM or slightly OTM

Expiration: weekly or monthly

IF SWING TRADE,

Strike : ATM or halfway between current price and target

Expiration: Always monthly

How to identify if the contract is ITM ? ATM ? OTM?

Let say, X Corp. is trading at a current price of $380.15

ITM (In the Money)

Call strike at $350

Put strike at $400

ATM (At the Money)

Call strike at $380

Put strike at $380

OTM (Out the Money)

Call strike at $400

Put strike at $350

One Final Thought

Mostly, we do scalp and day trade. We very seldom swing options.

Trading options is a different ball game.

This is a purely high risk trading as the cost of the bet can go to zero, easily. Far OTM with Zero DTE (date to expiration) were known for this. Trading this type of contract requires a lot of volatility and range. Otherwise, you are just throwing your money away in a position where odds is against you.

Knowing when to get in and get out is really very important.

Timing and speed of the stock’s price action are the two main factors we always consider before taking the option trade.

We highly suggest simulating this strategy and back test just to find out if this is really for you. As far as we know, this is the only way that works for us.