The reason why we are including cryptocurrencies in our portfolio is because we want to diversify our hard earned money.

Inflation is the greatest enemy of fiat currency because of the unlimited supply designed by the monetary policy. We believe that cryptocurrency particularly Bitcoin and Ethereum will be the storage of wealth in the future.

We only have Bitcoin and Ethereum in our crypto portfolio. When I lost my side hustle income during the lockdown, we started studying how Bitcoin works, since then the rest was history.

Now, we believe that these two serve like an index from the rest of the alt coins. If these two rally or sell off, so will the others.

If you don’t have any exposure yet and are thinking of getting some of these two, We’d like to share our simple strategy that we are using. Currently, we’re up by +82% so I guess this strategy works.

- The Strategy

My strategy here is a long and hold strategy. I don’t short any of these two because like I said earlier, we believe that this will be considered as a storage of wealth in the next years to come.

Using TradingView as a charting tool, I am using the 50 / 200 Moving Average in a monthly, weekly and daily time frame.

The strategy here is simple.

Once, the price action started to test the 50 moving average (red line) in a weekly time frame, that’s when I started to monitor the market sentiment.

As a buyer, I want to buy at a 200 moving average (green line), only after this level gets defended more than twice or shall I say bounced using the weekly time frame.

As a seller, I only start trimming the position if and only if the 50 moving average fails to reclaim twice using the weekly timeframe.

I use the daily time frame set – up for bidding and asking only if I want to buy or trim some positions.

- Why a weekly time frame and not in a daily time frame?

We are long on these two crypto assets (BTC and ETH). Weekly time frame is more smooth and clear to use as a buy and sell signal for us. I found the daily time frame too noisy if I’ll use this to monitor the market.

I think the key here is patience and emotion and keeping the rule simple during the times of sell offs.

- How to Buy Bitcoin / Ethereum?

I buy Bitcoin and Ethereum through crypto exchange then from it I transfer it to an external wallet for storage.

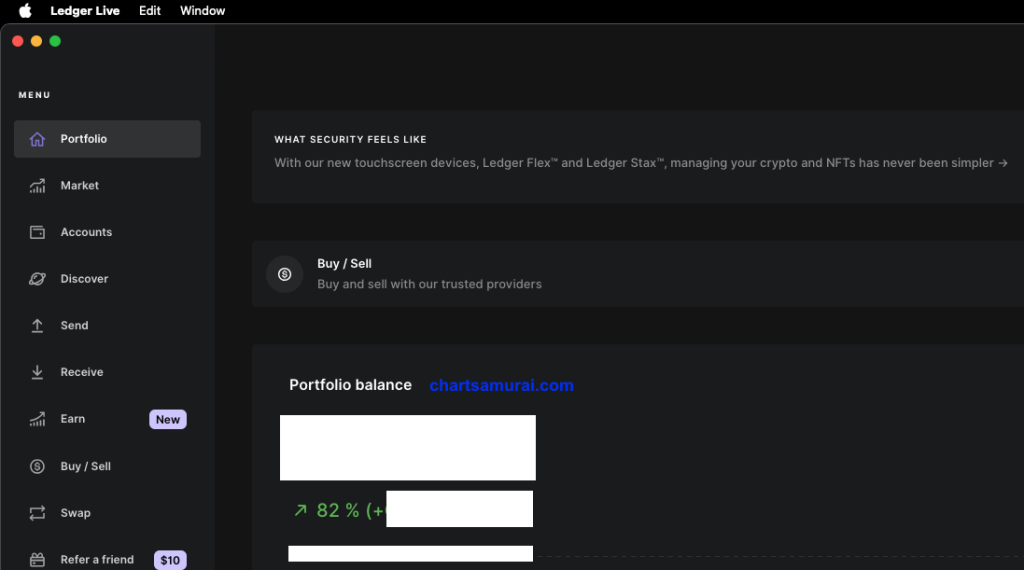

I use Ledger for this.

Ledger is like a usb and it stores your private keys in a secure and offline environment. You just have to take really care both the passkey and recovery phase otherwise if you lose these, there is no way to recover your bitcoin.

The reason why I do not leave the bitcoin keys in crypto exchange is that anything can happen. The fallout of FTX (another crypto exchange) will serve as a good example. Storing it in Ledger is way safer in my opinion as you have full control.

And when it comes to wealth accumulation, control is everything.

If you think Bitcoin is for you and wondering how to get it, here’s a very straightforward and simple step.

Using my affiliate link (you will get the same amount I will get, so it’s win-win set-up)

- Open a Coinbase Account – we both get $10 each once you buy and sell worth $100 within 180 days of opening the account.

- Buy a Ledger – this is where you will store your bitcoin key. Also, if you use my referral link, we both get $10 each.

All affiliate commissions go to Sick Kids Foundation.