Trading option contracts is a high risk high reward play and to win this game, you need to follow the trading rules you’ve set diligently. No exceptions.

This post I am about to write is all about how to find high probable winning trades using the most anticipated earnings that are to be released.

You will notice how the option interest increases especially if the stock is getting too much attention because of the publicity made by the media.

You try to avoid playing that because there’s too much IV involved and the price of the option contract on that particular stock was already priced at a +7% move in either direction already. So the odds of betting that move is favorable to the option seller and not the buyers.

But there’s another way to play that move. And that’s what I want to share here.

Here’s what we do:

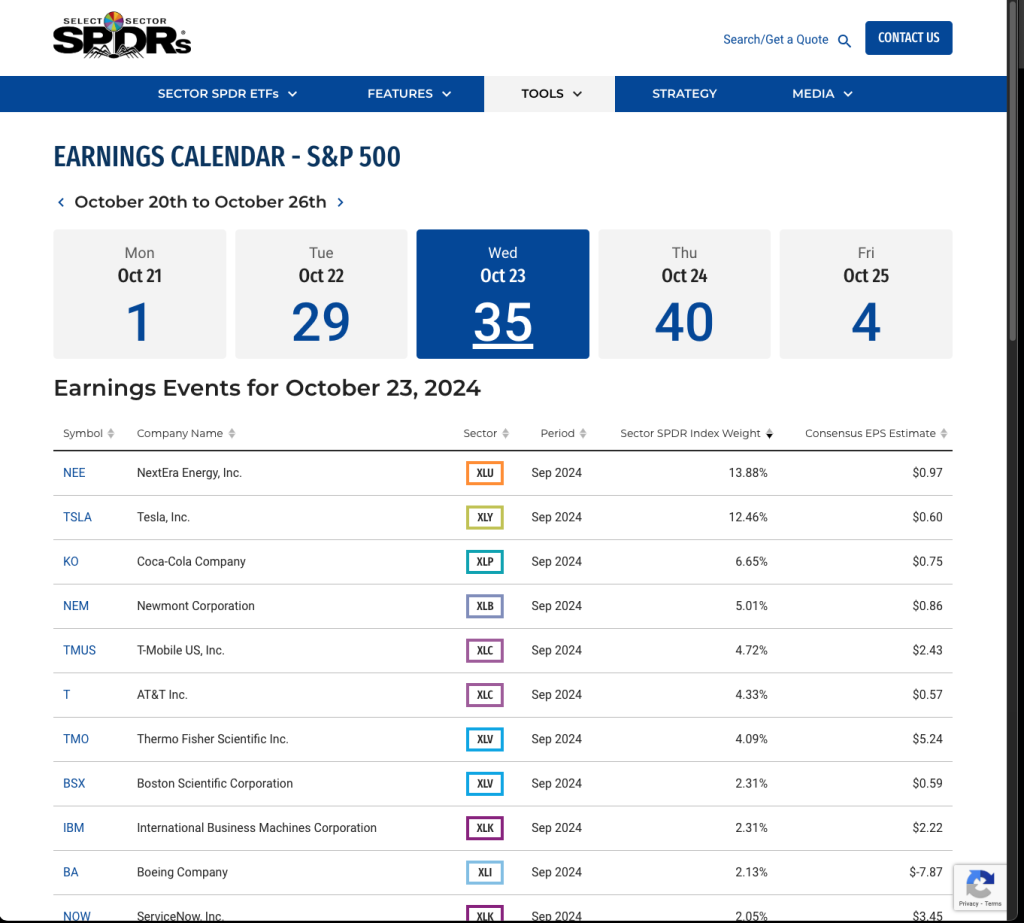

- Check the Earnings Calendar. You can access this free at https://www.sectorspdrs.com/ Find tools then earnings calendar. You can access the companies here that are part of S&P 500. There’s an account in X (formerly twitter) known as Earnings Whispers @eWhispers which provides weekly earnings releases.

- From that information, I select the companies that are taking too much publicity by the news. In this post, we will use TSLA (Tesla) as an example because this is the most anticipated earnings release that most traders have been waiting for.

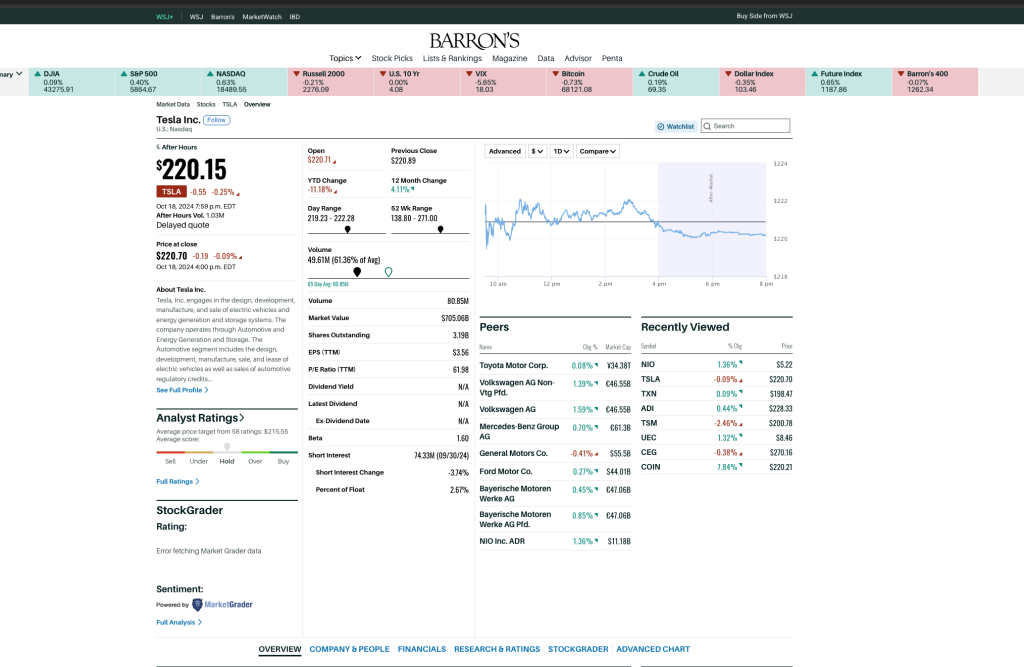

- Then I use Barrons.com to check the peers of the particular stock I chose. (I like Barrons because the related articles were already compiled and I read it and sometimes it helps). You’ll notice NIO (Nio Inc.) is one of its peers, and this one got so popular during the EV Hype and there’s a high probable chance that this will move as well because of TSLA earning result sentiment.

- Using TradingView as my charting tool, I will check NIO’s daily chart and see where it was trading last week, the pattern and the risk and reward if I will play this stock in sentiment of TSLA (Tesla) earnings result.

- Now, here’s the tricky part. We all know the delivery result of TSLA as it was already released before. Tesla’s shares plunged after that release so it’s already priced in. TSLA has been trading at the $219-221 range for the past days and the reason why it is not moving either way, a lot of investors and traders are waiting for the future guidance that the TSLA management will release and see if there’s still a future value left for this stock price to move up. In my opinion, I think TSLA will fill the gap to the upside. I think TSLA will beat the estimates and will release something valuable that will get the traders and investors excited to get back TSLA shares again. Let’s say, the cost to build is decreasing, and the margin is improving. CyberTruck reservation and orders are improving and charging stations are growing. Imagine if other EV car brands were able to use the TSLA charging station for a fee. That’s another cash cow for TSLA.

- Now that I have a Bullish thesis for TSLA, I will check back the chart of NIO again. In that chart, you will notice that NIO closed last Friday at $5.22 and it tested the 50 and 200 Moving Average Indicator. This is where I will bet a $6 strike for NIO call contract related to TSLA after the earnings release report. Like what I’ve said before, trading the option contract of TSLA is expensive and the odds are not on our side.

- And lastly, nobody knows what will happen to the market. We analyze the market and trade it. Our job after that is to manage the risk taken if our trade is wrong. That’s it. And if we are right, make sure we ride it enough to pay somehow for the previous losses we’ve managed. Like what the great traders used to say, “Cut the losers quickly and ride the winners’.