We traded GameStop before and we will trade this meme stock as long as there’s a reason to trade this.

Trading meme stock in my opinion is purely technical. You need pattern recognition, volume and price action.

It would be better to trade the long side of GME and other meme stock rather than sell short these as borrowing rate fee sometimes goes as high as 20%.

In this post, I will explain how we traded GameStop.

Here are the questions I always ask myself once the hype of the meme stock is back again.

- Why is it moving?

- Is there a set-up?

- Is there a volume?

- Where is the VWAP, intraday support and resistance?

Today, I will show you the platform of MB Trader.

GameStop was all over the news today as DFV/ Roaring Kitty posted his GME $116M stock and option position on Sunday evening. And today, June 3, 2024 eastern time here, this stock rallied at the premarket open at 4:00am.

Now, if you missed this 4AM party, you don’t trade it. You switch to a waiting mode.

You can’t be too early in the party or even too late, you just want to be there when the party is happening.

You wait for the pattern to set up again.

We love the bull flag pattern. We enter upon testing the intraday support heading to VWAP. Sometimes this level will be tested twice. Sometimes not. You just have to trade based on your risk appetite. Your position size should depend on where you are comfortable. You don’t trade 1000 shares then your heart pumps like crazy thus clouding your judgment.

Here’s the pattern:

Notice how MB Trader took the position after testing the intraday support. Since there’s a range between the intraday support and resistance, the plan here is to take out the position at the intraday resistance. Set limit buy, set limit sell, wait for the trade to work out. If not, hard stop once the support snaps. The key here is volume. Notice how the volume builds up heading to intraday resistance. That’s liquidity. That’s what we want. You want to be part of it.

You have to remember that we cannot move the market. We are just retailers, mere observers. So you just have to wait until such time the volume pick up again.

Here’s what happened after:

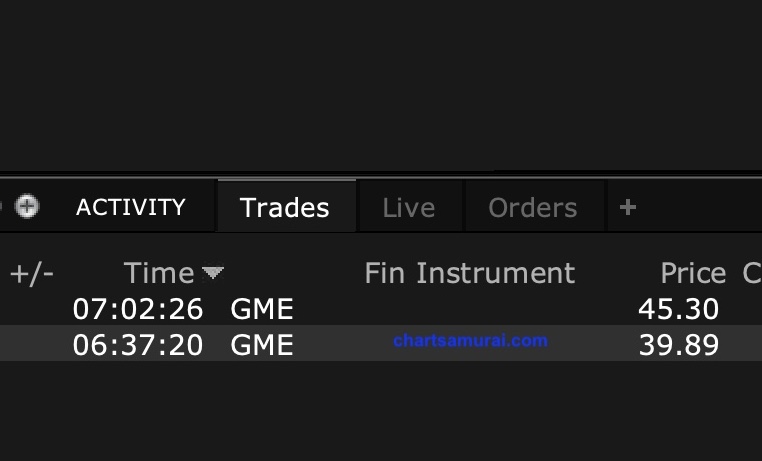

Here’s the trade log. Entered at 39.89 Exit at 45.30.

You can be successful in trading meme stock if you have a strategy in place. Some buy and hold, others swing the position, but for us I find it more effective in scalping. You just really need patience and discipline to wait for the set up to show.

As of this writing, GME is now trading at 29.92, which after that premarket double top pattern, the price haven’t recovered yet right after the market opens.