In order to accomplish our trading goals, we need a set of tools that will help us to achieve this and combined with the right mindset and proper knowledge, the opportunities to make money out of the market is limitless.

So these are the tools that we are using for now:

Brokers

- IBKR (Interactive Broker) for US Stocks and Options

- Wealthsimple for Canadian Stocks

- AB Capital Securities for Philippine Stocks

Charting

- TradingView Premium Plan

News Subscriptions

- WSJ Bundle (WSJ + Barrons + MarketWatch)

Our Brokers

If you want to trade anything in the market, you need a fast, low commission cost and reliable broker.

For the US Market – we use Interactive Brokers because the commission is low. The execution is fast and the market data subscription can be waived once you spend a certain amount of commission.

For the Canadian Market – we use Wealthsimple because they don’t charge commission in trading the Canadian Stock Market. If you use this platform for trading the US Market, you will be paying the foreign exchange fee and the commission for the US option is expensive compare to IBKR.

For the Cryptocurrency Market – we use Coinbase as a place to buy and sell. If I want to take the crypto out of this exchange, I use Ledger as a storage of the keys.

For Philippine Market – we use AB Capital because this is the only broker that allows me to open an account even if I don’t have proof of billing back there.

We liked this set up. At least our hard earned money is diversified into four different places.

Our Charting Tool

Is TradingView worth it?

Depends.

I will try to make this post as short as possible as I don’t like to stuff a lot of words just for the sake of SEO.

We are using TradingView only for charting and technical analysis. That’s it.

We don’t use it as part of a trading platform.

Why?

Because we feel comfortable trading within our brokers. Now some traders link TraderView into their trading platform but for us we just don’t do that.

We like TradingView because it is clean, simple and easy to use when it comes to technical analysis.

We also use this charting tool for:

- Building up watchlist through sector

- Charting stocks

- Writing up trading ideas (you can check mine here)

- Checking out some ideas stream from other tradingview users

- Joining trading competition from time to time (TradingView sometimes launch competition using paper trading account and there are prices waiting for the top contenders

If you are new in your trading journey, this is a good charting tool to start. You can actually use it for free but there will be ads popping up from time to time which is annoying.

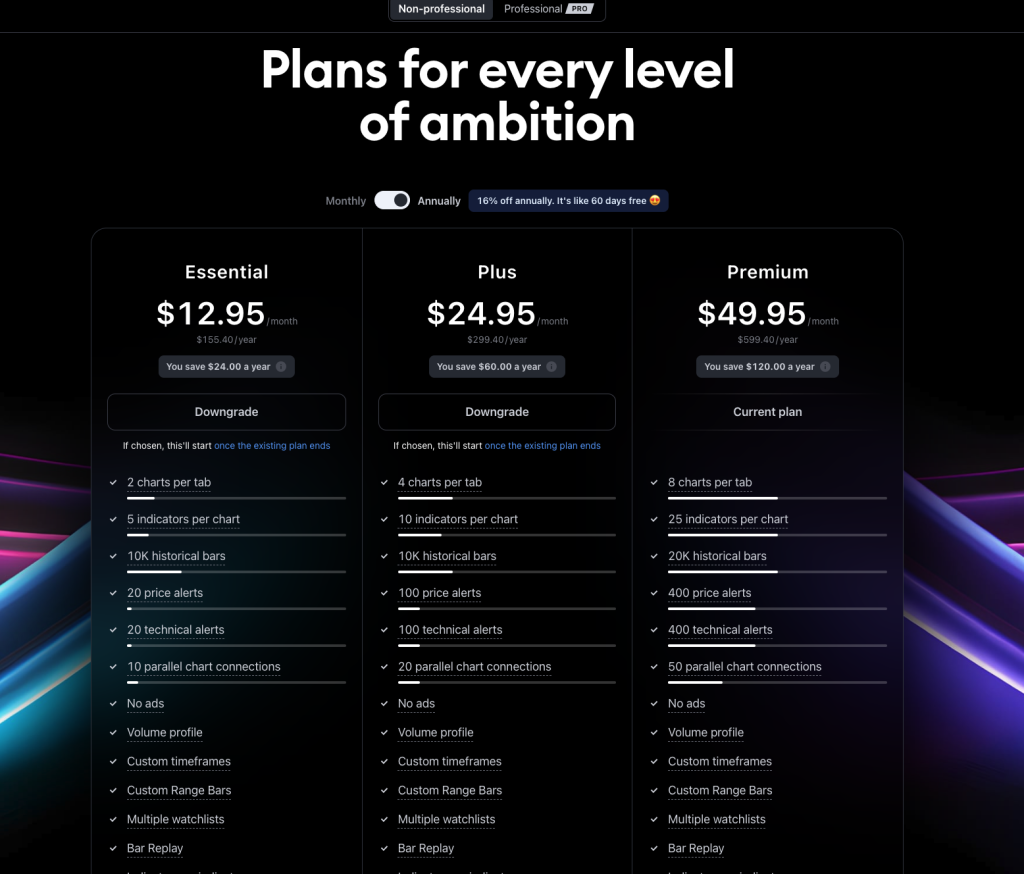

We used TradingView as free version for just 1 month and eventually signed up for the paid version during the Black Friday Event.

Currently, we are using the Premium Plan that cost us around $599.40/year or $49.95/month.

If you decide to sign up, I will encourage you to wait for special events such as Thanksgiving, Black Friday, Cyber Monday, Boxing Day because here you will get a big discount.

So going back to the first question, Is TradingView worth it?

Technical analysis, charting and building watchlist – yes.

Trading platform – no, as we use our own broker.

Our News Subscriptions

We get all the news from all over the world from our paid Wall Street Journal Bundled Subscriptions.

This includes WSJ + Barrons + MarketWatch. We are paying around $18.07/month for this service.

If you are using Interactive Brokers as your broker, you can get additional news alert from Benzinga Pro.

Benzinga Pro is also a stock market news and alert. Since our US brokers has a partnership with them, there’s no point for us to get a paid subscription.

For now these are the tools that we are using right now. You might be saying, that’s it?

And yes, for now this is it.

We want to keep everything simple.

The goal is to grow the account and not to look complicated from others.

It doesn’t make you smart enough if you have a complicated set-up.

Again, we want to keep everything simple.